The Icarus of Stock Market: Gautam Adani

The Rise

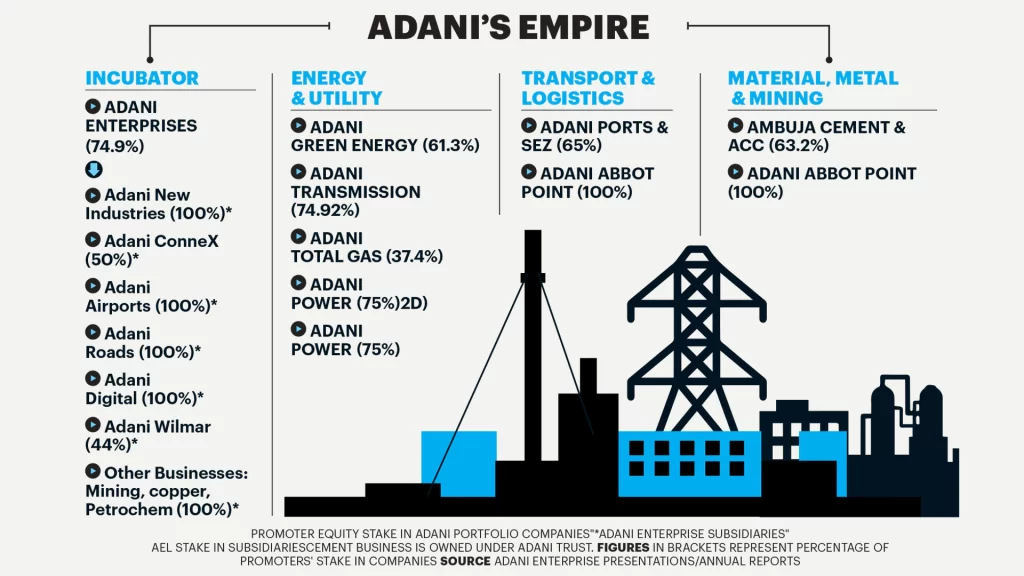

In the last year, the elite domain of billionaires was breached by a new player, whose swift rise to the very top of the list of the richest men alive was comparable to Elon Musk. Gautam Adani made heads turn and had almost everyone asking to know more about the billionaire industrialist who is the founder of Adani group, dealing in port development and other lucrative operations in India. In September 2022, Adani’s personal wealth was estimated at around 155 billion US dollars, making him the richest man in Asia and the 3rd richest person in the world, according to Forbes. In the last few months, the name ‘Adani’ spurred a feeling of regret in casual investors and investing firms, as everyone bemoaned “if only I had invested in Adani’s share last year.” For context, if one had bought shares worth around 1 lakh rupees on the 1st of January when the price of one share was 491 rupees, they’d have approximately 205 shares of Adani Ltd. If one had kept your shares for two years, at their peak. when one share of Adani Ltd was worth 3,995 INR, one could have cashed out almost 6 lakhs richer.

What could have possibly derailed Adani group’s meteoric rise to the top?

Hindenburg Research LLC is an investment research firm and a short-selling company named after the Hindenburg disaster of 1937, which the firm believes was a human made disaster that could have been prevented. The fiscal activists were inspired by this incident and aimed to do good by preventing human-caused financial disasters by publishing research implicating investment fraud and other foul play. Hindenburg Research operates by conducting an in-depth investigative analysis of a target by going through the company’s public records and internal corporate documents. A report is prepared and then distributed for Hindenburg’s corporate partners that specialize in taking a short position in the target company, essentially betting on the target company’s share prices falling. The report is then distributed to major news media outlets covering business and stock markets. The report unsettles existing investors and discourages new investors from buying shares in the target company. Hindenburg research and its partners make profits if the target company’s share prices plummet. Hindenburg Research gained mainstream attention after their 2020 investigation on Nikola, which was an electric truck company dubbed by experts as the ‘Tesla killer’. The report on Nikola alleged fraud and accused Nikola of doctoring the video showing their functional electric truck. The company’s share price tanked, and the valuation of the company was brought down to almost nothing with the founder Trevor Milton convicted of fraud charges. The research firm has now gained their corporate ‘Undertaker’ reputation and any ‘target’ company would be terrified to see Hindenburg Research investigate their operations.

The allegations

On the 24th of January, Hindenburg research alleged that Adani Group had engaged in decades of stock manipulation and accounting fraud. The research firm claims that Adani group’s companies have acquired a substantial debt and that investors should be wary of their seemingly fabricated company valuation. These allegations were presented in a 100-page document published last month and have wreaked havoc for all of Adani Group’s operations. Adani groups have lost over 100 billion US dollars in valuation and their reputation plummeted. The bad reputation and PR have prevented the business conglomerate from being able to get loans from international banks. Adani Groups have vehemently appealed the allegations and have offered a comprehensive 400-page rebuttal to the Hindenburg investigation report.

The Centre has agreed to create a committee of experts to recommend measures to plug in the gaps made by the regulatory regime and prevent loss for Indian investors caused during market volatility. SEBI (Security Exchange Board of India) is also probing into the allegations made by both Hindenburg Research and Adani Group. Adani Enterprises has recently been removed from the Dow Jones Sustainability Indices, and subsequently removed from the bond collateral lists of Credit Suisse, Standard Chartered, and Citibank.

Gautam Adani has denied all the accusations made and dubbed them as calculated attacks on India’s surging financial growth. The government of India is on notice as the success of Adani Group’s financial endeavors adversely affect the country’s stock market, major industries, and countless development projects. The solvency and reputation of Adani group is of national importance, therefore the stocks of Adani Group won’t plunge without a fight.

The stock market pandemonium means it is open season for all day traders, who are experts in investing in volatile stocks and monitor their stocks every hour to reaffirm their position. Adani Enterprises Ltd is the crown jewel of the listed Adani Group stocks and the one that took the biggest hit following the Hindenburg Report. On the 24th of January if one had 100 shares of Adani Enterprise Ltd, they would have approximately ₹3,34,000 and the next day the same shares would be worth ₹ 2,70,000. The rock bottom was on 3rd February, when the value of your 100 shares would be a measly ₹1,30,000. However the Adani share seems to rally every once a while and with the floodgates open a day trader or swing trader, who bought the same 100 shares valued at ₹1,30,000 could sell it for a ₹1,00,000 profit almost a day later. The row has made the entire stock market a volatile place which is perfect for new players to thrive and make surging thrusts forward.

Impact on Odisha

The financial turmoil caused by the reports isn’t confined to national and international sectors but finds its way to wreak havoc across Odisha’s development projects. The Adani group had recently committed to invest a staggering ₹60,000 crores ($7.39 billion) in a span of next 10 years. The Adani group’s development project would oversee the construction of a liquified natural gas terminal with 5 million tons of capacity at the Dhamra port in Bhadrak, Odisha. The investments would have contributed to the local economy and would have created thousands of jobs for locals. The continued fall of Adani’s net worth and financial reliability means that the plans for Odisha will have to be put on hold for the time being as the group looks to contest their allegations.

Maybe it was too much too soon, for outsiders it seems almost inconceivable that the third richest person in the world would be from a developing country like India. There had to have been an unsettling feeling creeping up in the financial world dominated by staunch American and European billionaires. How does a man from the poverty-stricken country of India manage to buy out entire ports in the coasts of Israel? The ongoing saga will keep unfolding as the weeks go by and day trades will be licking their lips at the prospect of investing in stocks as volatile as Adani Ltd and other affiliates. Maybe we learn to invest in slow and steady growth, instead of the explosive and unstable rise. Or maybe we learn how it is hard to fly closer to the sun with guns aimed at your back.

Sharing his opinion on the ongoing Adani-Hindenburg row, local entrepreneur and stock investor Shivam Agarwal said, “The value of my shares invested in Adani Group have dipped in the last few weeks but I am banking on the resurgence of their value. These are turbulent times for traditional investors, but a very lucrative opportunity for day traders and swing traders. Amidst this financial turmoil caused by the Hindenburg report, there is a small part of me that wants the allegations to be disproven and for Adani to come out of this unscathed.” The Bhubaneswar-based entrepreneur further explained, “My bias stems from the fact that I can’t help but feel that this is an American short seller putting us back in our place and punishing the investors for daring to dream. However, I put this bias aside because the story is still ongoing and the facts are there for everyone to see.”

The row with Adani group and Hindenburg research might have two conclusions. Either Adani group is guilty of all the allegations and going forward, public companies in India will be more transparent with their operations knowing that there are overseers carefully watching on and waiting to pounce on any misstep or Adani groups are able to partially deflect the allegations and leverage the continued support from the government and the LIC to solidify their position on the stock market and somehow salvage their reputation as industry leaders. Whatever the conclusion might be, Odisha, along with the world, waits in anticipation.